Zoral Behavioral Data Warehouse

“The problem with the internet is that you can’t see your customers. Behavioral data fixes that...”

Behavioral data can be highly predictive. It improves customer visibility and helps you make better decisions. It allows you to adapt your digital customer journey to each customer, improve conversions, increase automation, reduce cost, risk, fraud, defaults and much more.

The more you know about your customer, from the first point of contact onwards, the better you can respond. Companies who use behavioral data efficiently are more profitable. They react more quickly and appropriately to customer and market demands.

However, behavioral data is hard to gather and control. Plus it is difficult to build such systems from scratch. Also, not all behavioral data is predictive. Answering such questions as... “Which data items to collect? Which are predictive and when?” is complex, time consuming and often requires much trial and error.

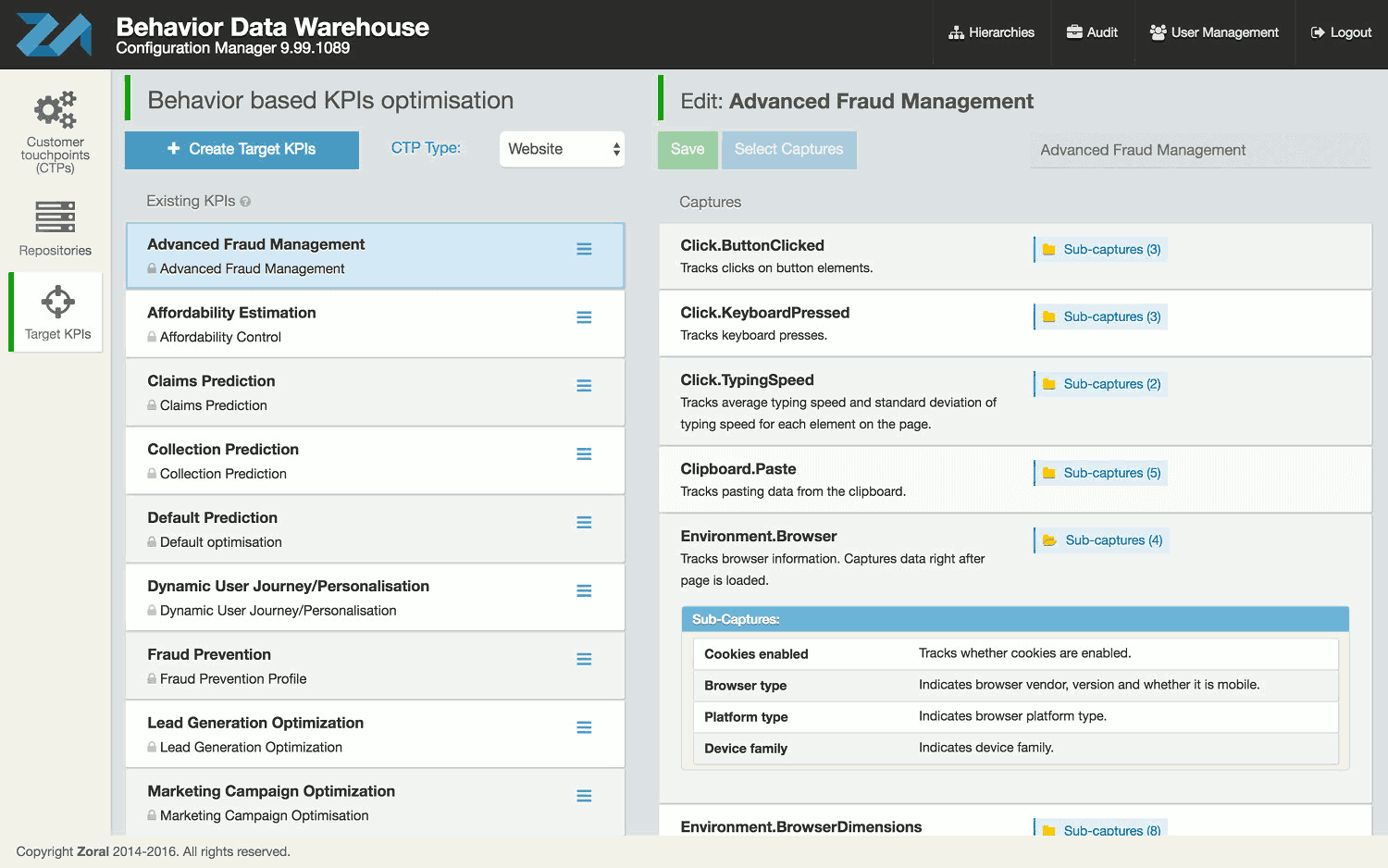

Zoral BDW solves this problem. Zoral BDW is a fully featured behavioral data warehouse with a comprehensive toolset. It automates the collection, storage and quality control of your behavioral data. Zoral BDW contains many 100’s of man years’ research into the commercial application of behavioral data. It knows which features are predictive, of what and when. So, there’s no need for trial and error.

By using Zoral BDW, your organization can rapidly implement and benefit from a fully functional, predictive behavioral data warehouse at a fraction of the time and cost it would take to build such a system in house.

Zoral BDW allows your team to focus on using behavioral data rather than the time-consuming tasks of trying to work out what is predictive, acquiring, testing and managing it.

What is behavioral data?

Behavioral data is derived from human, device or system behavior, as opposed to structured, application data.

For example, a user might be completing an on-line application for a product via your website. In this example, behavioral data might include: were bank details entered manually or using cut/ paste? when pasting, did they use the mouse or the control keys? how fast did they type? what device did they use e.g. tablet, phone, PC, iOT device, etc.? What version of the operating system does the device have? etc.

Typically, during a 1 minute, on-line session, between 5,000 - 12,000 items of behavioral data/features will be collected. Similarly, voice data might be captured via a service desk, digitized, extracted and combined in Zoral BDW. Using Zoral BDW we can build a comprehensive “picture” of the user, which can be highly predictive in a wide range of applications.

How is behavioral data used?

Behavioral data allows you to build a 360° picture of your clients. It can be used for far more than just simple scoring, (e.g. credit scores etc.). For example, by the way people type, the way they press the keys and use their mouse etc., we can accurately predict age, sex, level of education, identity and many other items.

Typically, predictive behavior data is combined with “conventional” data such as, application data, credit bureau data. This can significantly boost the accuracy and range of predictive results. This should come as no surprise. Banks and Insurance companies used to operate via branches and agents. They would see and get to know their clients, observing 100’s of behavioral characteristics, which they would use in making sales and service decisions.

For example, an insurance agent, calling at a home might notice that there is a new car in the drive, children’s toys in the garden and that the house has recently been repainted. These observations would immediately “tune” his sales approach and views on risk, choice of product, pricing etc.

With e-commerce, this contact has been lost. However, using Zoral BDW it can be replaced and improved. Having good quality, behavioral data allows better understanding and prediction of likely behavior. However, it can help beyond simply improving or boosting the performance of existing, predictive models. It enables you to “see” previously hidden detail.

Zoral BDW makes a big difference

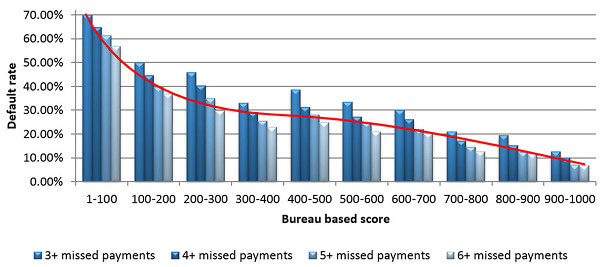

For example, Graph 1 shows an actual loan portfolio categorized, using credit bureau data, into 10 risk score categories, (highest risk of default on the left, 4 categories of default, etc.). Whilst it is reasonably efficient at discerning the extremes of “good” and “bad” risk, you can see that it becomes flat and “confused” around the middle range.

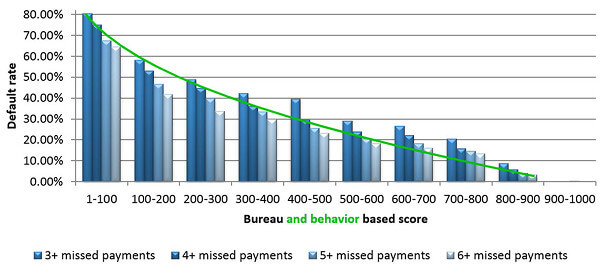

This is significant as, based on this, many “good” risk clients will be rejected or “bad” risk ones accepted. In reality, many companies simply avoid this part of the market, or approach it with great caution. However, if we add Zoral BDW behavioral data to the same portfolio analysis, the impact can clearly be seen, as shown below in the Graph 2.

It is now much clearer, with the distinctions in the mid- range exposed. Thus, Zoral BDW not only increases the accuracy of decisions, but also widens your market reach. For some clients/market sectors this translates to a 15%- 20% increase in addressable market. So, Zoral BDW can make a big difference.

Zoral BDW is easily installed and integrated

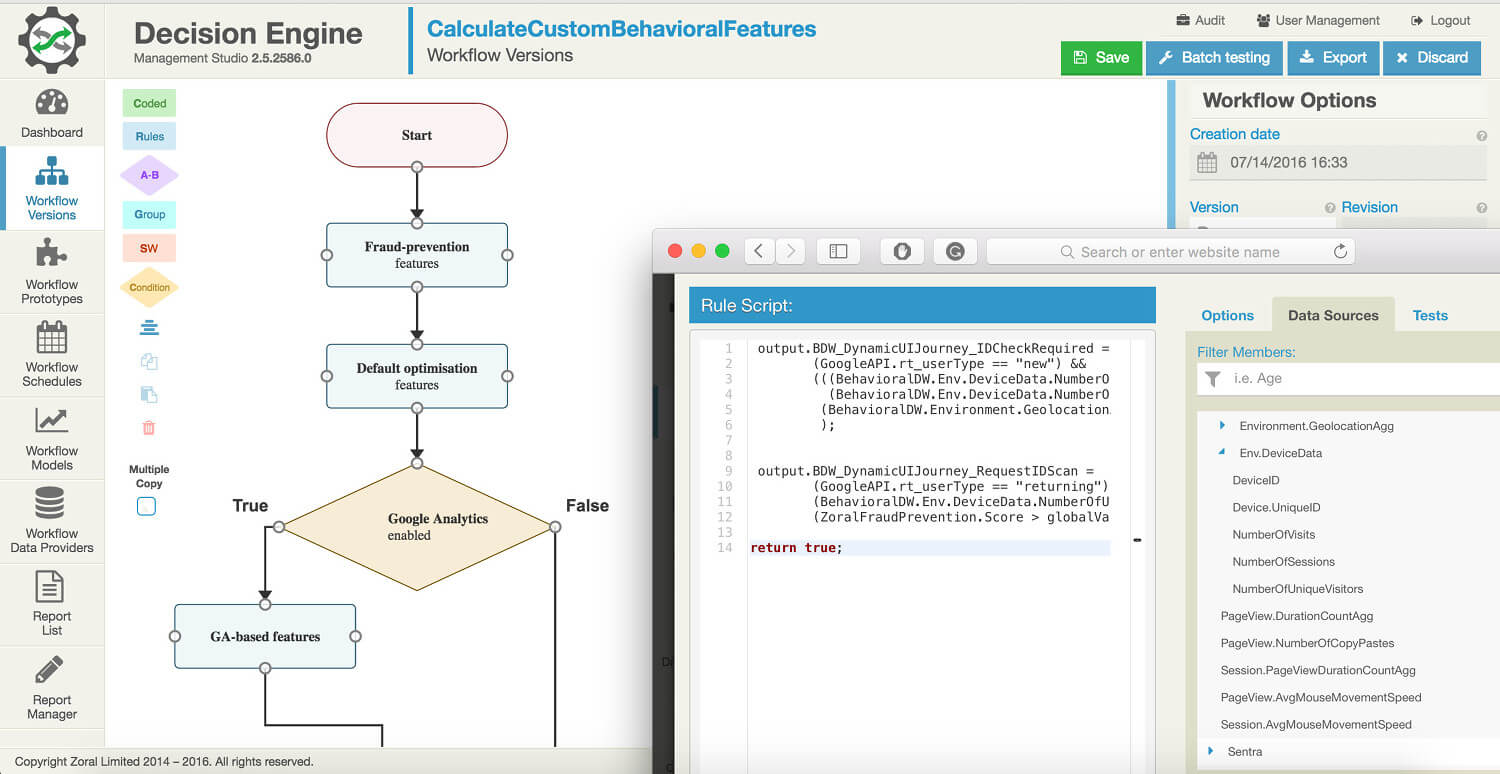

Zoral BDW data can be easily integrated with other predictive data sources. Using this combination, you can achieve a significantly higher degree of accuracy than using conventional data sources on their own.

Zoral BDW also improves decision speed. It is gathered in real time, so can be used for instant decisioning, whilst your customer is interacting with the system. It can perform real-time data enrichment so your system can make automated, intelligent, next-best-action decisions. Also unlike many other data sources, behavioral data is free.

You can optimize many functions by using Zoral BDW data in decision workflows and models. For example,

- digital marketing

- robo-underwriting

- dynamic customer segmentation

- customer lifecycle management

- conversion optimization

- fraud detection/prevention

- retention management

- risk adjusted pricing

- churn prevention

- collections optimization

- marketing campaign optimization

- cross-sell, up-sell

- user identification

- KYC

- user digital fingerprint

- next-best-action

- mass personalization

- dynamic customer journey

- affordability prediction

- claims prediction

- and many others.

Features List

- Highly extensible

- Create calculated features in real-time

- Fully configurable data collection

- Exclusion of private or sensitive data

- Powerful API for raw and calculated data

- Non-intrusive, data, minimal performance overhead on applications

- Seamlessly integrates with web sites, mobile applications and other customer touch points, across devices

- Equipped with Zoral data capture / integration toolset for rapid implementation

- SDK for Mobile Apps, intelligent data capture to optimize device battery life

- Integrates customer behavioral data across devices and touch points

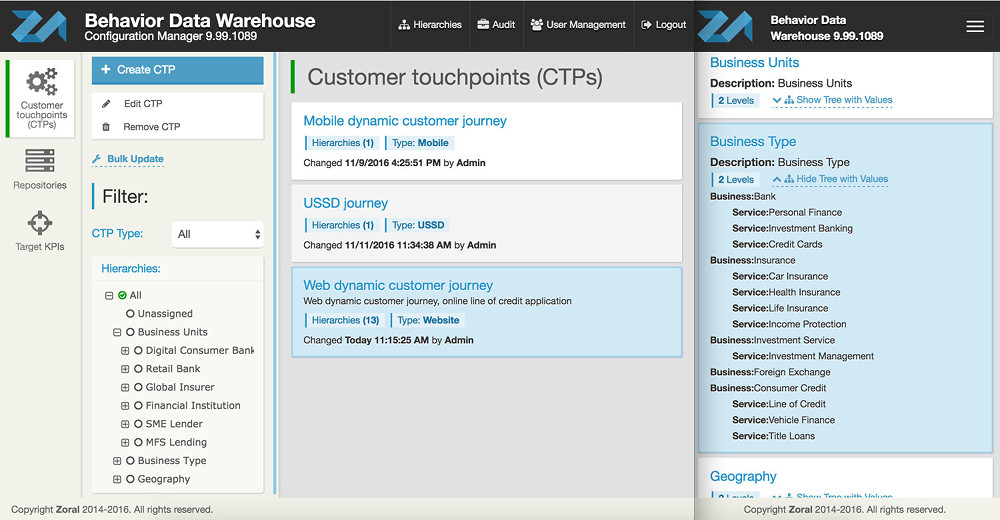

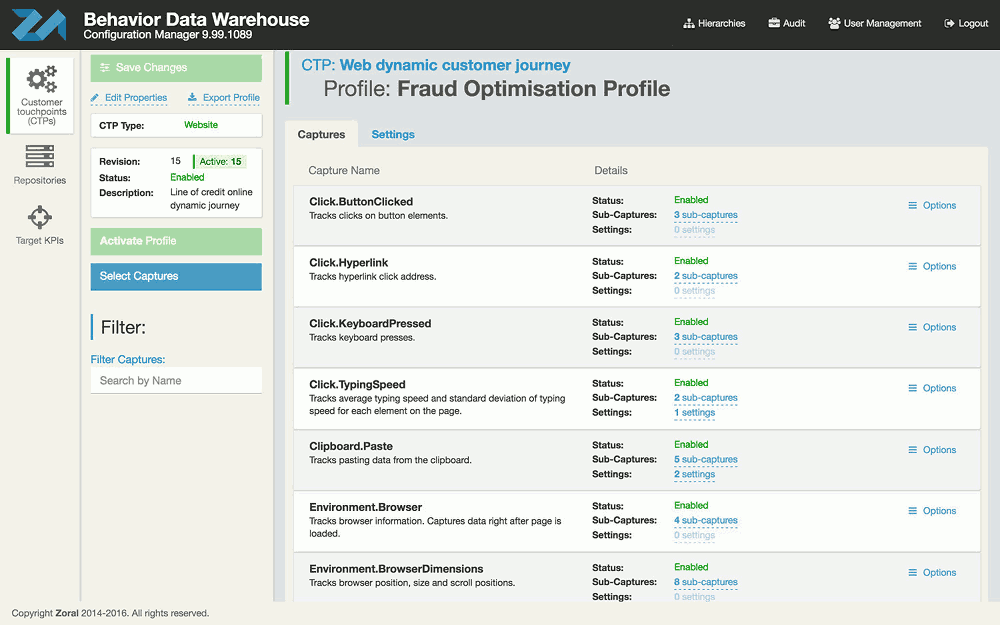

- User-friendly, web-based configuration manager

- Highly secure. Create/modify users, user accounts, roles and entitlements

- Full audit trail and role-based user management for enterprise security and compliance

- Capture/ correlate customer journey behavioral data

- Higher level activities e.g. re-apply, re-new, new contract, self-service enquiry, etc.

- Scalable, big data and enterprise architecture

- Supports real-time data capture from multiple web, mobile, iOTdevices

- Single or multiple behavioral data warehouse repositories

- Create multiple, customer behavior profiles

- Specify which features to collect for each device and touch point

- Predict and manage specific types of customer behavior

- Enable or disable data capture for any customer behavior profile

- Customizable dimensions and hierarchies, e.g. organisation, product, market and other dimensions

- Manage digital products and data capture across the enterprise

- Synchronize and integrate behavioral data across multiple devices, customer touch points and dimensions, e.g. customer behavior profiles, geographies, products, company lines of business and others

- Integration of behavioral data with underlying business processes, customer activities and other data as part of behavior data enrichment