Zoral Model Library

“If it were just a question of credit scoring then everyone would have solved the problem by now...”

Whenever people consider models in the context of credit they usually think of credit scores or default probability. These are important measures and useful, but they are only a small part of the picture. You need to know far more if you want to provide digital products, achieve good results and intelligently automate the process. This is why Zoral created Zoral ML. It comprises a large range of models, covering the entire customer lifecycle. It contains over 300 man-years of research, development and global deployment.

Answering questions

As leads flow into your system and customers arrive, you need to answer intelligently, key questions such as,

- do we want to purchase or process this lead?

- which product should we sell?

- what is the probability of fraud?

- what is the probability of default?

- when might those issues occur?

- If the customer defaults, how likely are we to collect?

- what is the customer life time value?

- should we underwrite this business?

- how should we price it?

- what limits should we apply?

- have we fully checked affordability?

- how do we optimize conversion?

- how likely is the customer to churn?

- how should we adapt the customer journey to optimize the above?

- if accepted, what does customer on-going behavior tell us?

- what are the next best actions?

- should we offer the customer additional products?

- when, how should we contact the customer?

- and many others.

To do this requires a profound understanding of all, applicable data sources and how/when they can be used. Much of this can only come with experience. This experience is contained in Zoral ML.

There is no “silver bullet”

Also, there is no “silver bullet:, i.e. a single model or set of models that can solve the above. To do this requires a combination of techniques, e.g.

- statistical

- linear

- non-linear

- artificially intelligent

- machine learning

- ensembling

- collaborative

- boosting

- NLP

- etc.

Zoral ML contains all of these.

Nothing stays the same

Things don’t stand still. Market demographics, consumer behavior, competitive response, fraud techniques, data quality etc., evolve over time. Models that performed well a few months ago, might start to deteriorate. To maintain stability and adapt, an automated system needs to be self monitoring, learning and alerting automatically as things change. Zoral ML was deigned from the outset to do this.

Data changes too

Today there are a huge range of data sources available. This is helpful, but...

- quality can rapidly change

- real-time availability can vary

- not all data is needed in every instance, (e.g. some sources are expensive and not always required)

Zoral ML manages all of this.

Zoral ML scope

Zoral ML covers the entire customer lifecycle and a wide range of market sectors

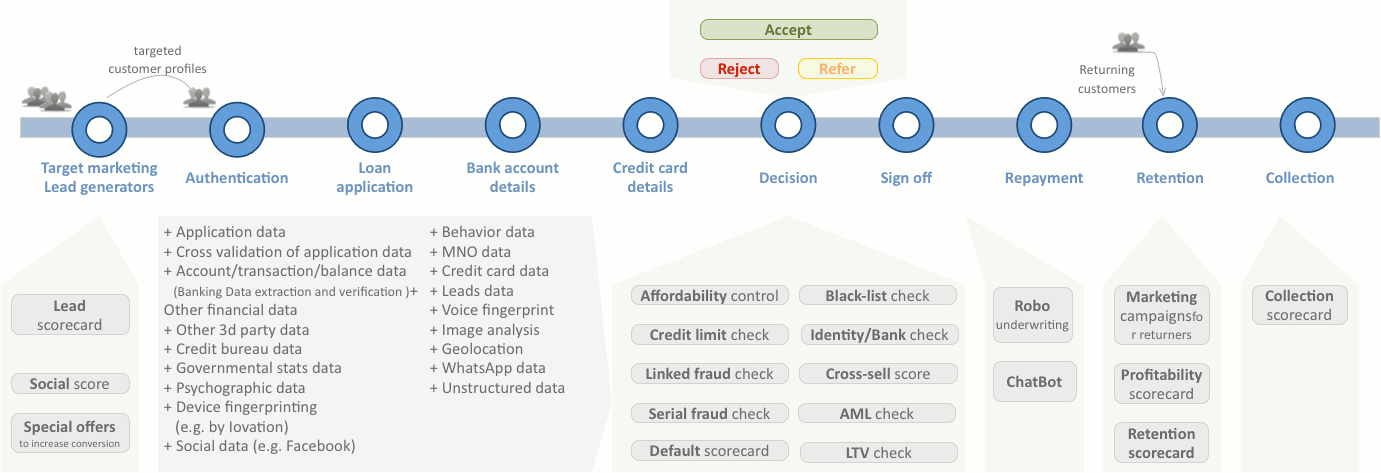

A sample mobile lending customer lifecycle

Sectors

Sector covered by Zoral ML include...

- lending

- leasing

- financial Institutions

- fintech

- mobile financial services (MFS)

- insurance

- E-Commerce

- car finance

- debt management

- e-Banking

- retail banking

- credit cards

- credit and collections

- digital marketing

- digital products intelligent transformation

- credit risk management

- wealth and personal finance management (PFM)

- remittances

Functional scope

A selection of the functions covered by Zoral ML is shown below.

- Robo underwriter

- Default prediction

- Fraud prediction

- 1st party fraud prediction

- 3rd party fraud prediction

- Multiple accounts discovery

- Linked accounts discovery

- Serial fraud prediction

- Anomaly detection and prevention

- Retention prediction

- Customer Life Time Value (LTV) prediction

- Intelligent limit management

- Risk adjusted pricing

- Lead evaluation

- Conversion prediction

- Affordability estimation

- Acceptance prediction

- Social scoring

- Renewals prediction

- Fraud related gaming prediction

- Cancellations prediction

- Mid-term cancellations prediction

- Claims prediction

- Behavior based credit score

- Marketing segmentation

- Propensity for add-ons prediction

- Cross-sell prediction

- Up-sell prediction

- Lease overpayment prediction model

- Collateral valuation

- MFS credit scoring models

- MNO churn prediction models

- Right Party Contact (RPC) models

- Dynamic RPC models

- Revenue prediction/optimization

- NPV estimation

- Portfolio profitability estimation

- Portfolio what-if scenario analysis

- Predicting time of default

- Prediction of collection amount after first call attempt

- Refinancing probability of default

- Collectability time prediction

- Contactability estimation model

- Methods for contactability model

- Collection schedule model

- Robo-collector

- Debt portfolio valuation

- Dynamic customer segmentation

- KYC verification models

- Identity verification models

- Chargeback fraud detection

- Predictive data cost optimization

- Predictive data quality monitoring

- Model quality monitoring

- Model automated retraining

- Customer behavior modeling

- Targeted marketing models

- Channel optimization models

- Operational errors monitoring

- System health monitoring

- Intelligent customer life cycle management

- Fuzzy matching

- Unstructured data entities extraction

- Sentiment analysis

- Customer-care models

- Budgeting and Provisioning module

- Automated categorization

- ...and many others

Why Zoral ML?

- contains 300 man-years of Zoral data science and risk management expertise

- state-of-the-art, robust, comprehensive AI/ML models, methods and tools

- wide range of model validation and calibration options

- contains extensive digital product transformation experience

- handles a wide range of predictive data sources

- advanced predictive data strategy with proven methodologies

- supports regulatory compliance management

- optimized for big data, speed, scalability, accuracy and profitability

- flexible API’s

- designed to work with a wide range of data sources, including device, bureau, behavioral, unstructured, MNO, social, financial, third party and many others

- in global use

- easily tuned and adapted to your product, market, sales and portfolio needs