Consumer Online Insurance

The insurance industry has a long history of using statistics and actuarial science. However, digital products provide an entirely new range of data. These are not yet being fully utilized, plus require the application of advanced AI/ML techniques.

What impact do these have? Can they be used to improve results? If so, how? How much difference do they make?

The following case study provides answers to these questions and shows that their impact is significant.

Whenever people consider analytics in the context of online insurance they usually think of risk, e.g. pricing models based on risk/claims probability. Predicting claims is an important measure and useful, but it is only a part of the picture. You need to know far more if you want to provide insurance online and achieve optimum results.

For example, you need to model lead acquisition, channel optimization and predict renewal conversion probability, fraud/gaming, cancellations and many other factors. The customer journey should be personalized and intelligently automated and the range of predictive data captured expanded.

The following Zoral software was used in the project

| Zoral decision engine | Zoral DE |

| Zoral model library | Zoral ML |

| Zoral analytical data workbench | Zoral ADW |

| Zoral behavioral data warehouse | Zoral BDW |

The client

The client is a major insurance company, focused on subprime and near-prime, personal auto insurance in the UK and continental Europe.

The majority of the client’s customers arrived via online aggregators and online price comparison sites. For each customer arriving at the website or App, the questions shown below needed to be answered accurately and immediately, prior to purchasing or progressing with the lead. This was important, as many were arriving from price comparison sites and were shopping for the best quotes. So response had to be optimal and immediate. Key automated decisions were required for the following:

- do we want to compete for this customer?

- do we want to purchase this lead?

- is the potential customer likely to convert to a sale?

- what is the probability of fraud/gaming?

- which products and add-ons should we offer?

- when/how should we contact the customer if the journey is abandoned?

- how likely is the customer to cancel the policy once purchased?

- how likely is the customer to renew the policy?

- how many times is the customer likely to renew the policy?

- what is the probability of default?

- when might this occur?

- if the customer defaults, how likely are we to collect?

- what is the claims probability?

- what is the claims frequency and severity probability?

- what is the estimated customer life time value?

- should we underwrite this business?

- how should we price it?

- how should we adapt the customer digital journey to optimize the above?

- if accepted, what does customer on-going behavior tell us?

- what are the next best actions?

- should we offer the customer additional products?

- do we need to gather more data to answer the above and, if so, which items?

- and many others

The client was using well proven, claims and policy management systems. However, more was required to compete profitably and accurately answer the above questions online at quote time. The client was using internal data sources, (e.g. loss history), but needed also to incorporate new consumer behavior and 3rd party predictive data elements. These were essential to support its modeling, analytics and pricing.

Problem

As a first phase, it was decided to focus on improving:

- cancelation

- fraud/gaming

- renewal

- claims

- default

- add-ons upsell

- conversion

- pricing and

- profitability.

The client wanted to utilize real-time advanced analytics, new digital data sources and assess their impact on the above KPI’s.

Implementation Approach

-

Using Zoral MVP Methodology, Zoral conducted rapid assessment to identify the impact of the Zoral toolset and potential business value. The following, key questions were addressed:

Assessment Result does client data contain more predictive quality than is currently obtained? YES can this be further enhanced by adding social/behavioral data and other 3rd party data? YES what is the likely scale of improvement? Significant what is the best implementation path for high ROI POC results? Build Analytical Data Warehouse, apply Zoral DE and Zoral ML, tune Zoral ML model suite - Built and deployed Analytical Data Warehouse (ADW)

- Validated and tuned Zoral ML models on production data

- Integrated Zoral DE with real-time pricing and rating insurance broker work-flow

- Assisted in training/business adoption of Zoral DE / Zoral ML advanced analytics.

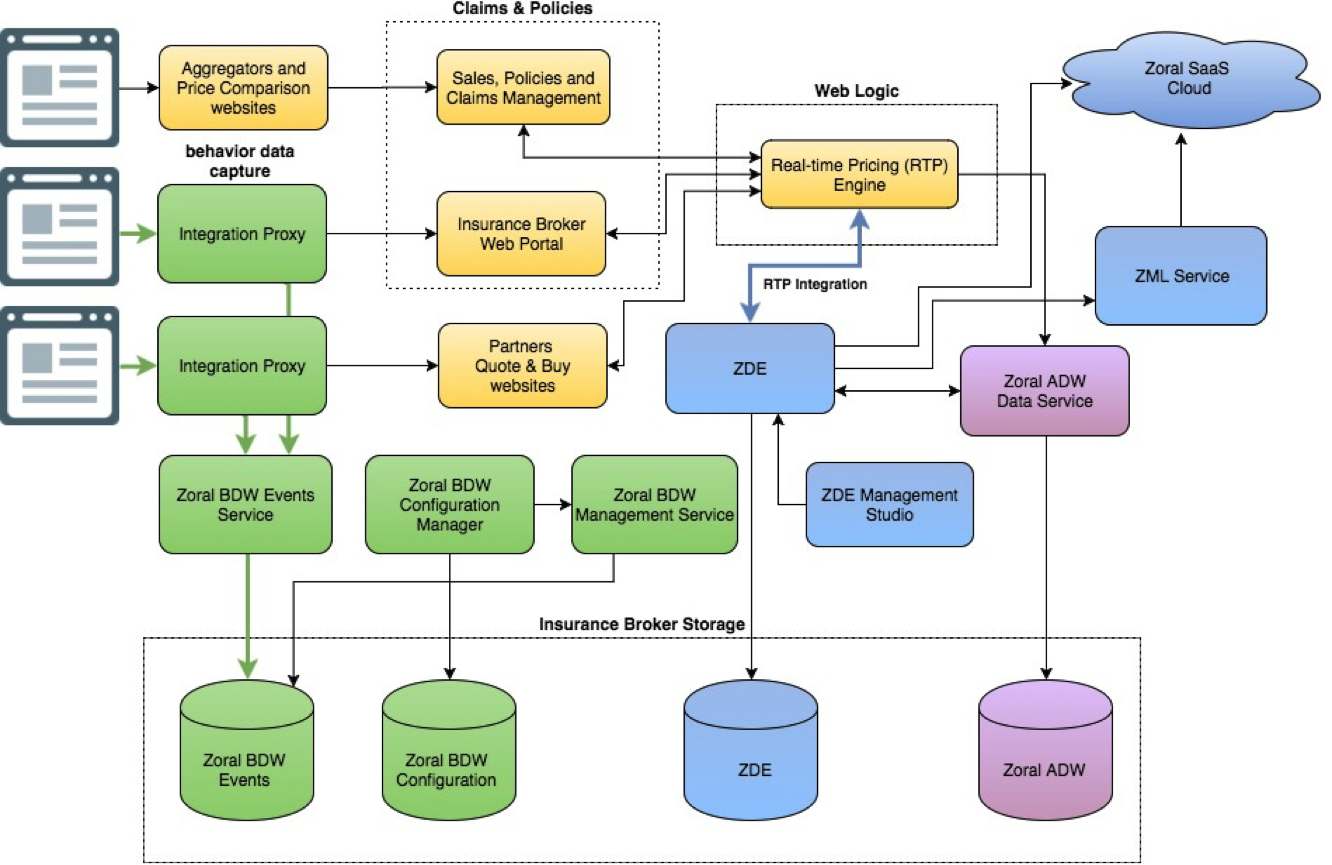

Zoral BDW was integrated to the client’s websites, portals and mobile applications in order to capture customer behavior, device and social data. A range of internal and external data sources were integrated, including bureau and aggregator data. Zoral ADW and Zoral ML were applied. Zoral ML tuned models included,

- default prediction

- fraud/gaming detection

- renewal and cancellation prediction

- conversion prediction

- add-on sale prediction

- claims probability.

These were optimized using the data available. Their primary use was to serve as real-time inputs to the insurance broker pricing engine at quote time. The Zoral ML models were benchmarked against the client’s existing, production models, where available. The benchmark results were promising, but also revealed a number of predictive data quality issues. Zoral analytical data workbench was installed and populated to solve these prior to productionalization.

The raw, internal data was extracted from multiple insurance broker systems, cleansed, enriched, transformed, integrated, and loaded into ADW.

A further range of additional, predictive data was added. This included aggregator, behavioral, social, device, and bureau data.

Zoral DE / Zoral ML models, utilizing ADW were then integrated to the client’s real-time, pricing engine to produce improved rating decisions.

After comprehensive testing, an enhanced, intelligent pricing system was deployed to the client’s production environment as shown below.

Zoral DE / Zoral ML Results

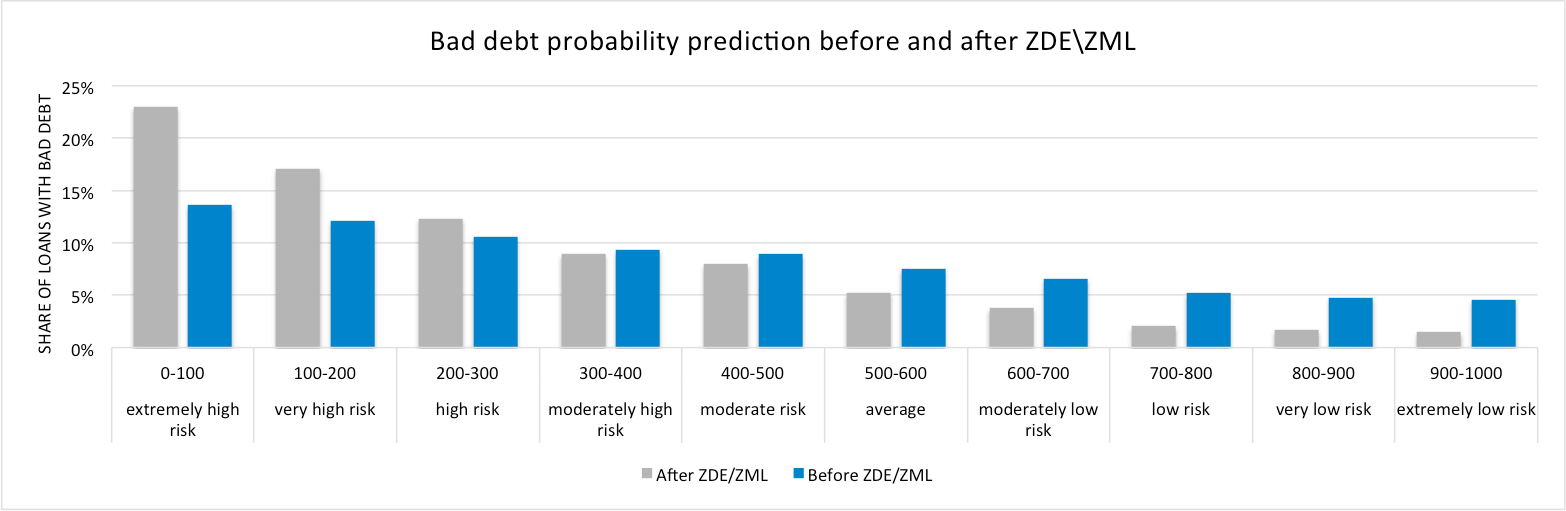

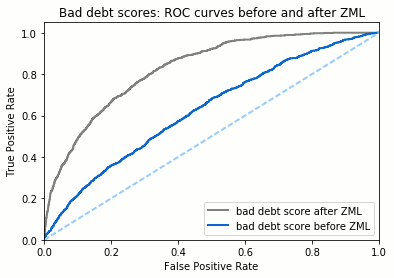

Default prediction

More than a half of the client’s customers chose to pay for their auto policies in installments. However, the full premium was paid to the partner insurance company at the policy start. Thus, the client bore part of the customer default risk. As the result, profitability relied on the ability to measure and manage customer credit risk accurately.

As shown in the graph below, Zoral DE / Zoral ML considerably improved the accuracy of bad debt or default prediction. This was achieved using sophisticated non-linear prediction algorithms and additional, new digital data sources.

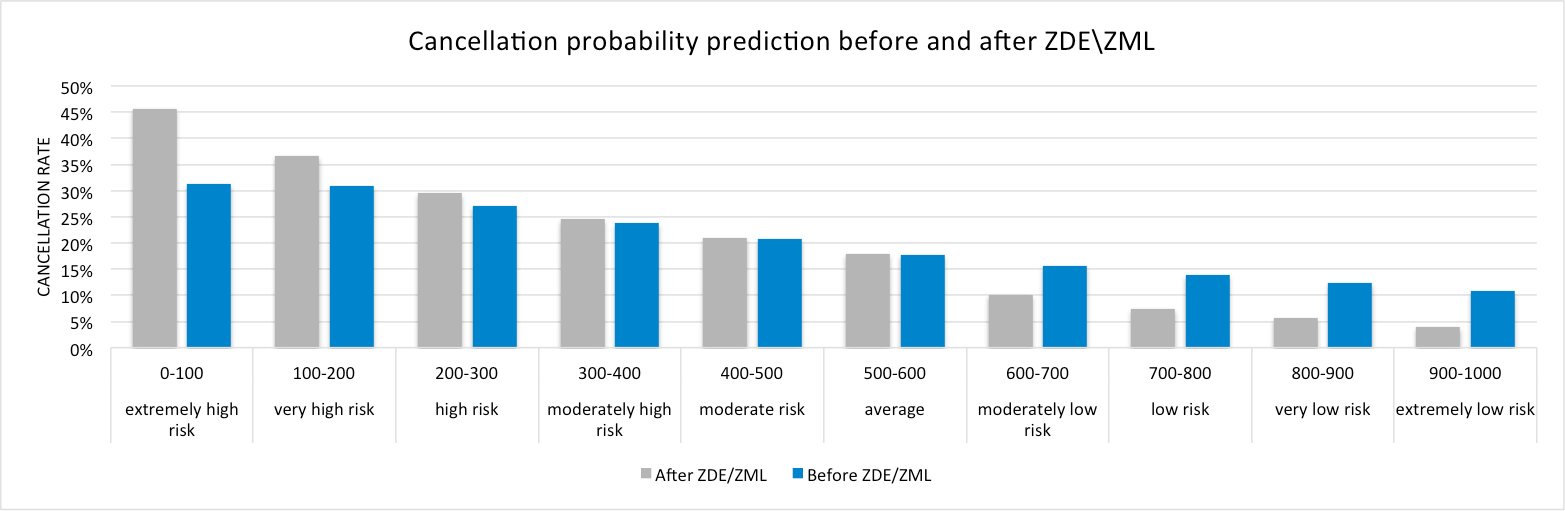

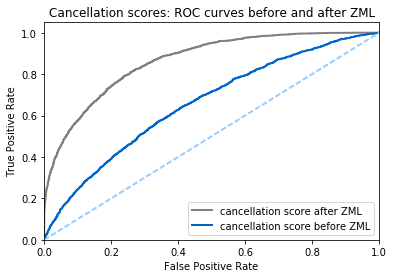

Cancellation prediction

Cancellation of an insurance policy reduces the customer LTV and leads to decreased profits or even loss. So, it was important to estimate the probability of cancellation at the policy quotation stage to allow for this risk to be reflected in pricing.

The Zoral ML cancellation prediction model was tuned using the customer’s data, plus a range of additional data including social, digitized speech and other unstructured data sources.

The additional digital data sources made a significant difference, as shown below.

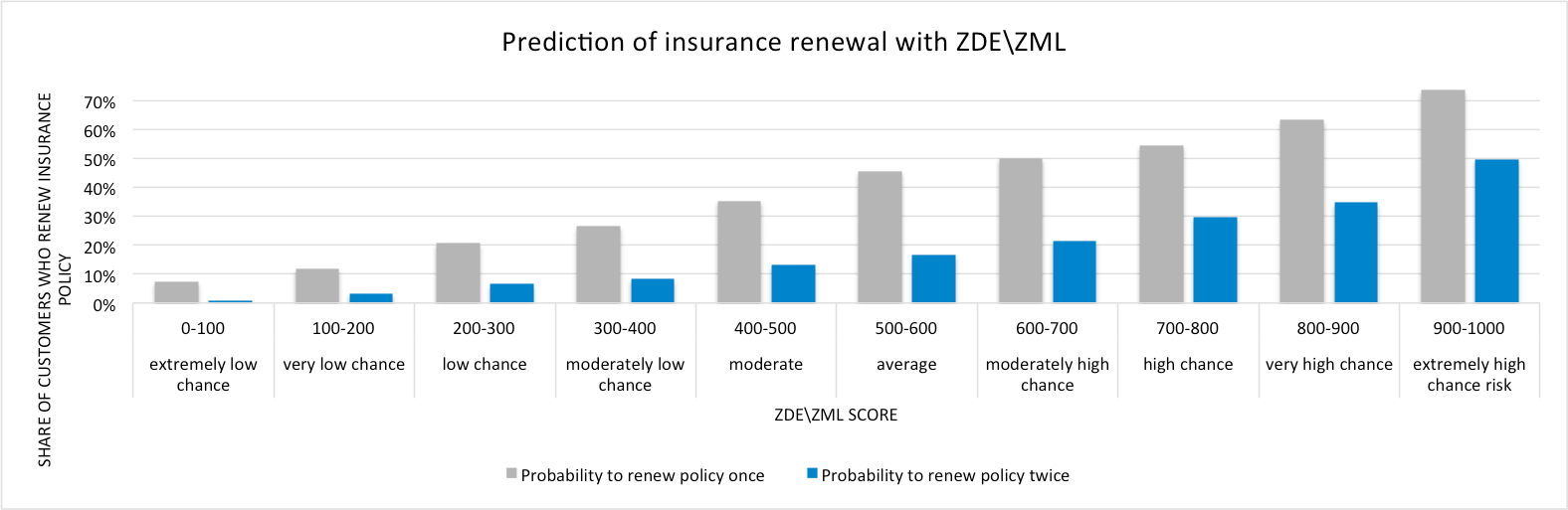

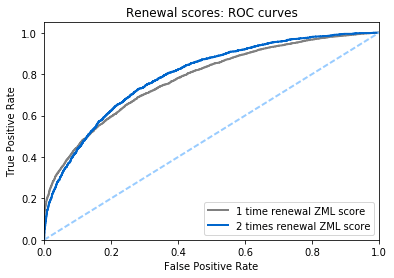

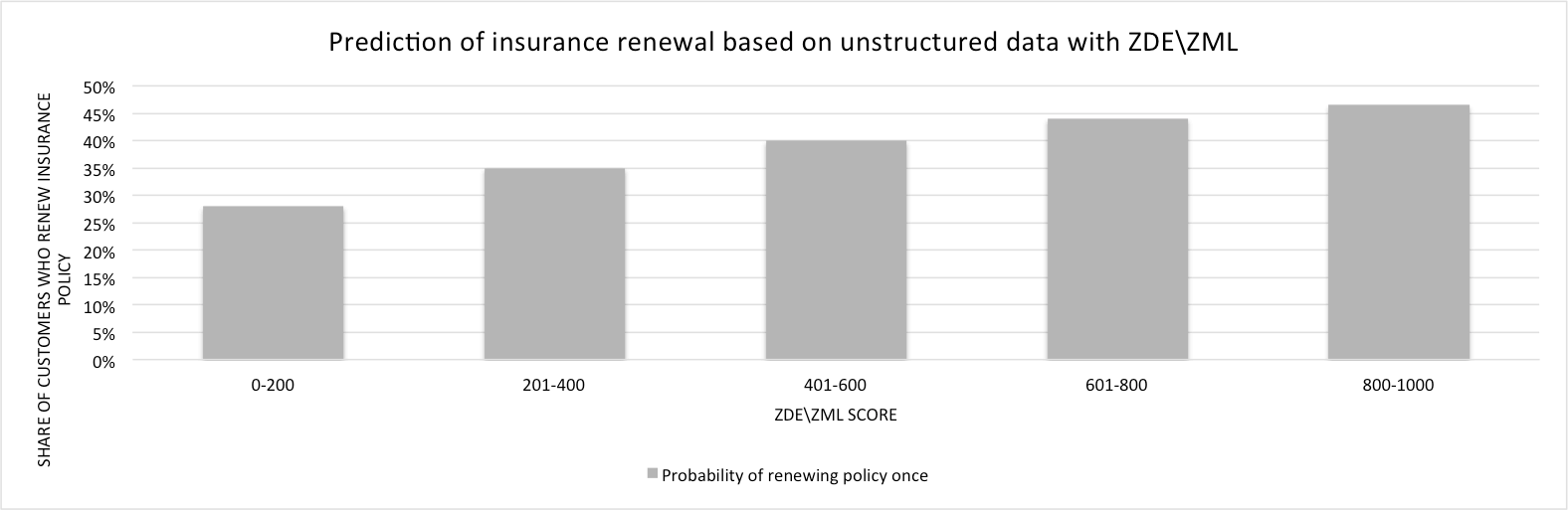

Renewal prediction

New customer acquisition is expensive. In addition, the 1st year premium was often discounted to acquire the “right” customer. Renewal was a key factor, as it affected the customer’s LTV and the overall profitability of the business. Zoral ML renewals prediction was applied using Zoral DE. Summary model performance is shown in the graph below.

As a part of the data enrichment strategy, Zoral utilized unstructured data from live-chat and CSR notes as an additional input to the renewal prediction model:

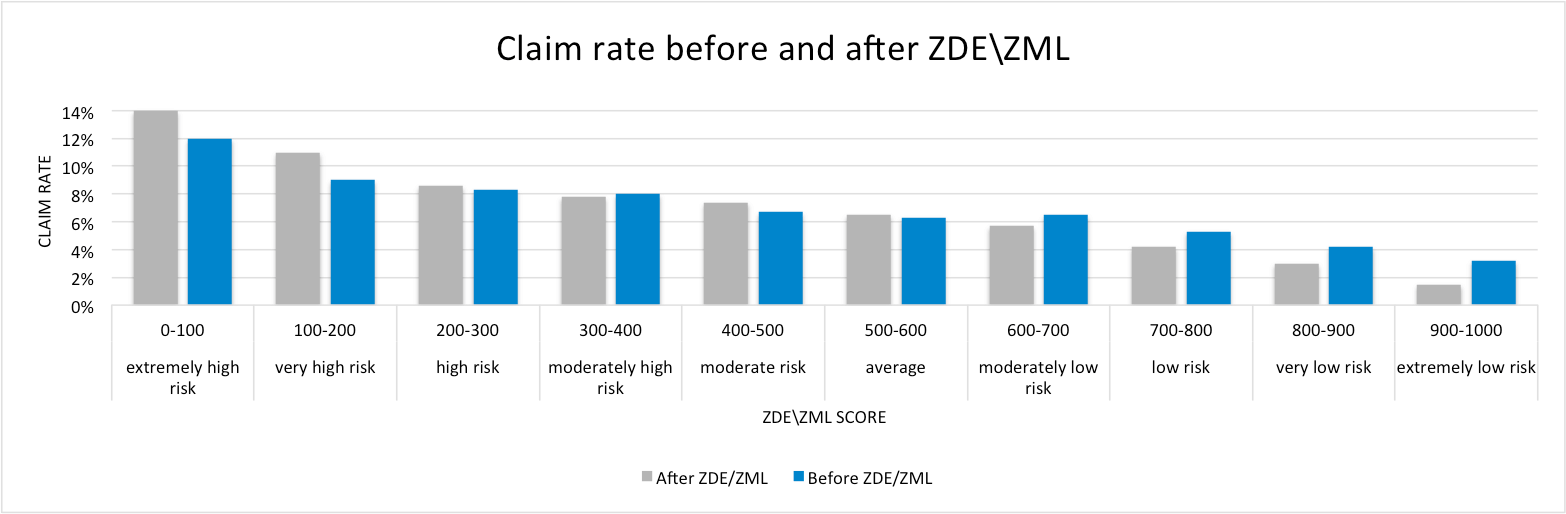

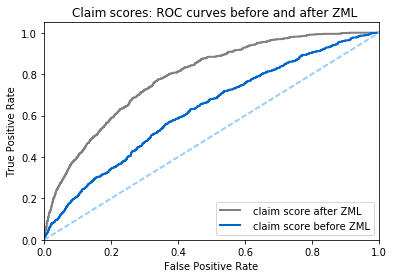

Claims prediction

Claim prediction is a key factor in determining insurance policy price. Also improvement in claims prediction at quote-time provides an insurance broker with the ability to negotiate better pricing and terms with partner insurance companies. Zoral DE / Zoral ML claims prediction models were applied and the results shown below. The results show a more “discerning” model output with overall better scores. This is particularly useful in the mid-range of risk, where the existing client models had become “confused”.

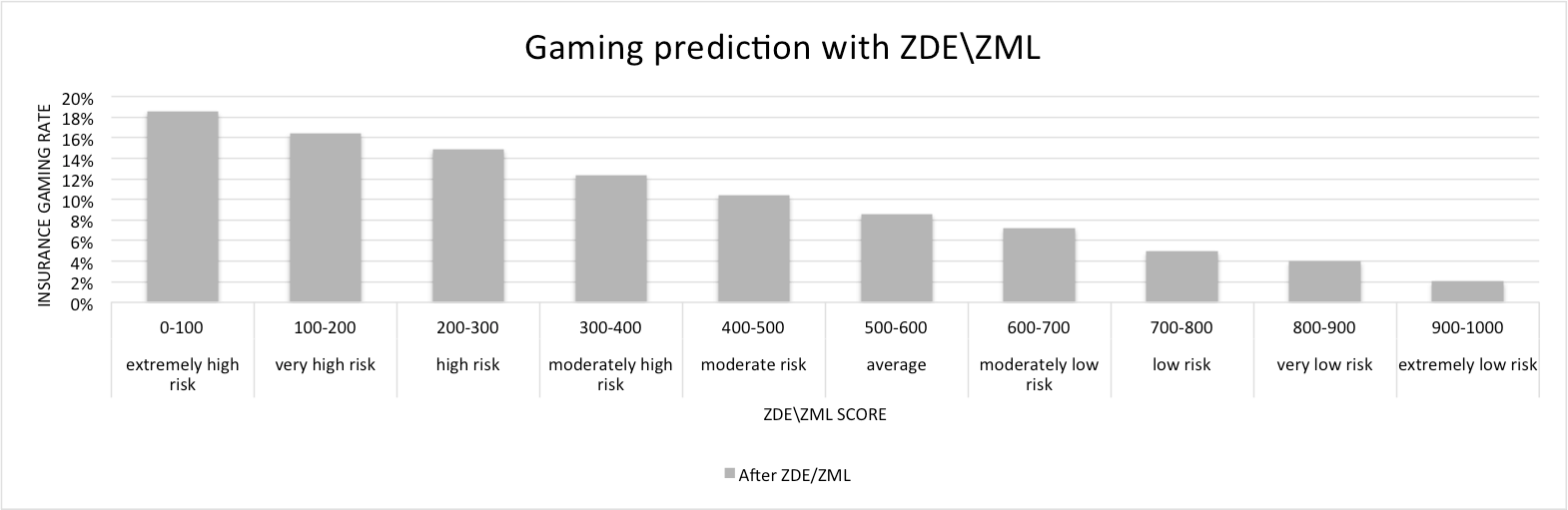

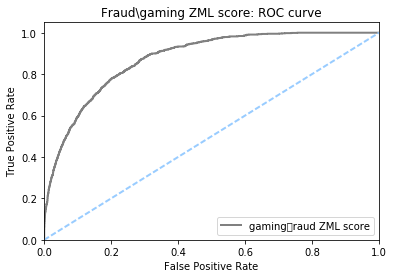

Fraud/Gaming prediction

Customers who intentionally change their personal data to reduce the premium also have a high cancelation rate. They also perform worse than expected in terms of credit risk and renewals. Detecting segments of customers who tend to “play” with insurance quotes allowed further improvements in the pricing strategy.

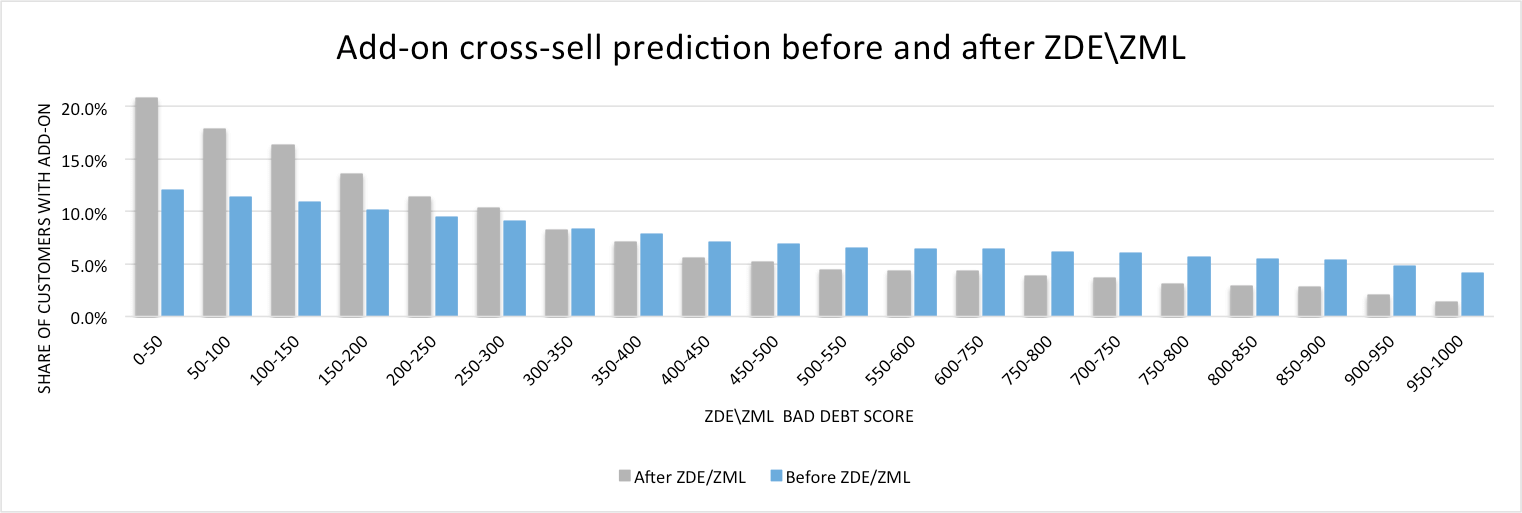

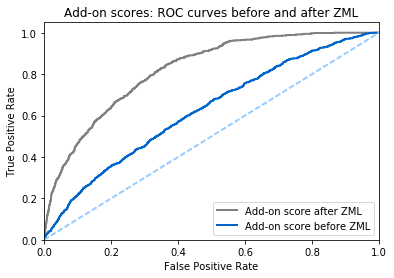

Add-ons cross-sell prediction

To acquire a new customer, a reduction in the auto policy price can be offset by a customer who is likely to buy policy add-ons. The Zoral ML add-ons cross-sell model calculated the likelihood of a customer buying specific add-on products at quote time.

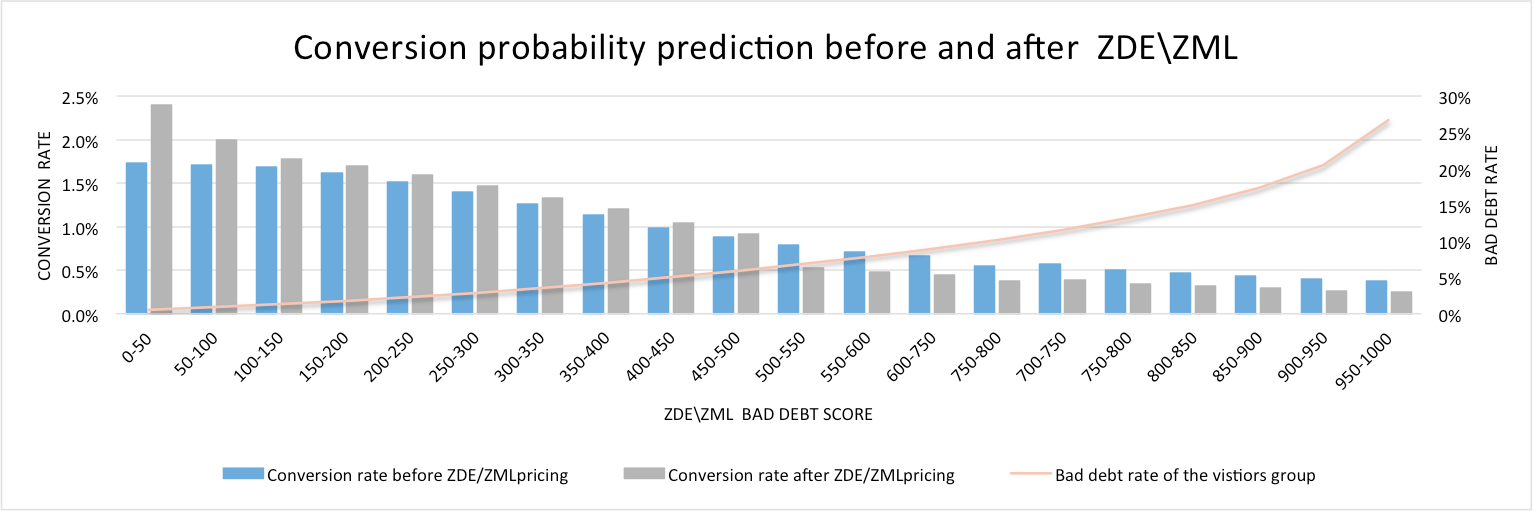

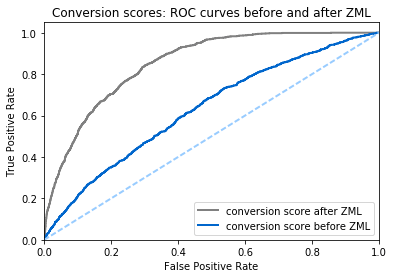

Conversion prediction

The Zoral ML conversion model increased conversion rates within low risk customer segments by offering them progressively better terms. It increased profitability within high-risk customer segments by charging them a higher premium.

Results

The results achieved are summarized below:

- 10.2% overall increase in portfolio profitability

- 17.3% increase in add-on profitability

- 47.1% increase in conversion

- 11.8% improvement in cancellation prediction

- 13.9% improvement in default prediction

- 20.4% improvement in renewal prediction